The RBA provided no surprises following its April board meeting leaving the official cash rate on hold at 1.5%.The RBA remains more confident regarding global growth, sees Australian economic growth as moderate, regards the labour market as being mixed, sees a gradual rise in underlying inflation and continues to see conditions in the housing market as varying considerably across the country, but sees recent regulatory measures as reducing the risks associated with high and rising household debt. This note looks at the outlook for the cash rate, the impact of bank rate hikes and the implications for investors.

The RBA provided no surprises following its April board meeting leaving the official cash rate on hold at 1.5%.The RBA remains more confident regarding global growth, sees Australian economic growth as moderate, regards the labour market as being mixed, sees a gradual rise in underlying inflation and continues to see conditions in the housing market as varying considerably across the country, but sees recent regulatory measures as reducing the risks associated with high and rising household debt. This note looks at the outlook for the cash rate, the impact of bank rate hikes and the implications for investors.

RBA likely on hold well into 2018

Our assessment is the cash rate has probably hit bottom after falling from 4.75% in 2011 to a record low of 1.5% last year and that the next move will be a rate hike but not until second half 2018. Another rate cut looks unlikely because:

-

economic growth is okay – having bounced back in the December quarter after a temporary slump;

-

national income is up from its lows thanks to higher commodity prices;

-

the RBA expects underlying inflation will gradually rise; and

-

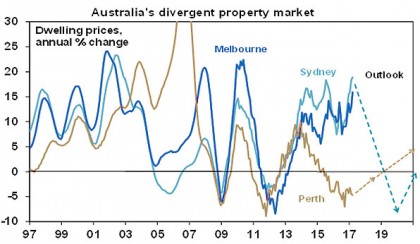

the Sydney and Melbourne residential property markets are uncomfortably hot with prices up 19% and 16% respectively over the last year and 75% and 50% respectively over the last five years posing financial stability risks if prices and household debt continue to rise.

By the same token it’s too early to be thinking about hikes as:

-

unemployment and underemployment (ie. labour underutilisation) at over 14% are way too high;

-

this is maintaining downwards pressure on wages growth which is at record low of 1.9% year on year (in terms of the historical record for the Wage Price Index);

Source: ABS, Bloomberg

-

the $A remains too high and is up from January last year;

-

underlying inflation risks staying below target for longer – reflecting low wages, the rise in the $A and competition;

-

there are risks around economic growth as the contribution to growth from home building is likely to slow this year and retail sales growth is weak at a time when mining investment is still falling; and

-

bank “out of cycle” mortgage rate hikes have delivered a (“modest”) de facto monetary tightening any way.

The RBA has to set interest rates for the average of Australia so raising interest rates just to slow the hot Sydney and Melbourne property markets would be complete madness at a time when overall growth is still fragile, underlying inflation is well below target and property price growth elsewhere is benign or weak. The best way to deal with the hot Sydney and Melbourne property markets and excessive growth in property investor lending into those markets is through tightening lending standards, which APRA has just moved again to do.

By the second half of 2018 the drag on growth from falling mining investment is likely to have ended, stronger global growth should have started to help Australian growth and stronger employment growth should have started to benefit full time jobs and wages and the threat around below target underlying inflation should have subsided. All of which should allow the RBA to start raising interest rates. But on current indications it’s hard to justify RBA rate hikes before then.

But what about bank out of cycle rate hikes?

The banks have recently raised rates for property investors and on interest only loans by around 0.25% and for principal and interest owner occupier loans by around 0.03%. The stated drivers were higher funding costs (presumably following the back up in global bond yields over the last six months) and regulatory pressure to slow lending to investors and higher risk borrowers. More moves may lie ahead if global borrowing costs rise further but again would be focussed on investors & interest only mortgages and in the absence of RBA rate hikes are likely to be small as only 20-30% of bank funding is sourced globally. But it’s worth putting “out of cycle” moves in context:

-

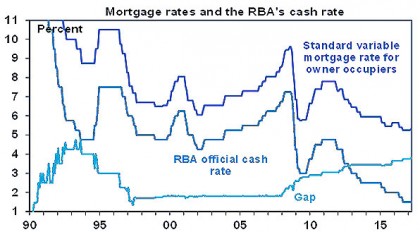

The RBA is still in control. “Out of cycle” bank moves have been a regular occurrence since the GFC and yet this did not stop mortgage rates falling to record lows in response to RBA rate cuts. As can be seen in the chart below the virtually fixed 1.8% gap between the standard variable mortgage rate and the cash rate only applied from 1997 to 2007, prior to that the relationship was far less stable so “out of cycle” moves are nothing new. The chart shows that changes in the cash rate remain the main driver of mortgage rates. If the RBA wants to lower mortgage rates again it can just cut the cash rate till it gets the mortgage rates it wants.

Source: RBA, AMP Capital

-

So far the changes in owner occupier rates are unlikely to have much economic impact because 3 basis points is trivial compared to the 200 basis point rise in mortgage rates that occurred in the 2009-10 monetary tightening cycle. So don’t expect much impact on consumer spending albeit there is negative psychological impact.

-

Changes in investor rates have less impact on spending in the economy because they are tax deductible and investors are less sensitive to rate moves. That said investor rates have gone up by around 0.52% compared to owner occupier rates since 2015 and this will eventually have some dampening impact on investor demand.

House prices

While strong population growth means that underlying property demand remains strong, the threats to the hot Sydney and Melbourne property markets are building: more macro-prudential measures to slow lending to investors and to more risky borrowers have been announced; the banks are raising rates out of cycle particularly for investors; the May budget is likely to see a reduction in the capital gains tax discount; all at a time when the supply of units is surging; and home prices are ridiculous. Taken together these moves are likely to result in a significant dampening impact on home price growth.

Source: CoreLogic, AMP Capital

We continue to expect a significant cooling in price growth in Sydney and Melbourne this year followed by 5-10% price falls commencing sometime in 2018 after the RBA starts to hike rates. By contrast Perth and Darwin are getting close to bottoming (as the mining investment slumps nears its low) and other capital cities are likely to see continued moderate growth. Unit prices are most at risk given the increasing supply of units.

Will rate hikes crash the economy?

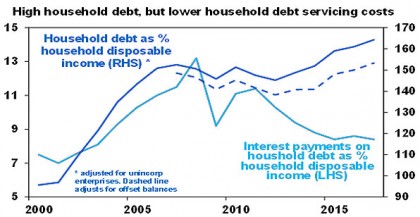

There seems to be a view that household debt is now so high that any hike in interest rates will cause mass defaults and crash the economy. This is nonsense. Yes household debt is up but not dramatically since the GFC and interest payments as a share of household disposable income are at their lowest since 2003. Mortgage rates would need to rise by nearly 2% to get the interest servicing ratio back to its most recent 2011 high – which slowed but did not crash the economy. And most Australians are ahead on their debt payments.

Source: RBA, AMP Capital

Finally, the RBA will move gradually when it does start to raise rates and knows households are now more sensitive to rate moves and so it probably won’t have to hike rates as much as in the past to cool any overheating in the economy.

Implications for investors

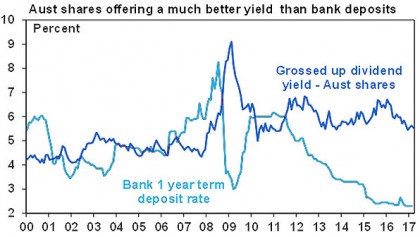

There are several implications for investors. First, bank term deposit rates are set to remain very low. As a result, there is an ongoing need to consider alternative sources of income. Second, be cautious of the Sydney and Melbourne property markets, particularly units. Third, remain a little bit wary of the $A as an on hold RBA at a time when the Fed is likely to hike rates another two or three times this year could put downwards pressure on the $A. So retain some exposure to unhedged global shares. Finally, with low interest rates growth assets providing decent yields will remain attractive. This includes unlisted commercial property and infrastructure but also Australian shares which continue to offer much higher income yields relative to bank term deposits.

Source: RBA, Bloomberg, AMP Capital

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.