Senior economist Diana Mousina answers our questions on potential interest rate changes and what it could mean for Aussie households.

Why have interest rates been so low for so long?

The main reason interest rates have been kept so low is the Reserve Bank of Australia undershooting on its inflation target of 2-3%. We haven’t seen underlying or core inflation within that band sustainably since before 2014.

As well as inflation, a few other factors have kept growth in Australia below trend over the past decade—even before the pandemic.

Mining investment peaked back in 2012 and then after that there was a period of weaker GDP growth. Wages growth has been pretty low as well at about 2% annually when normally it should be closer to 3%.

And there’s also been spare capacity in the labour market with the unemployment rate, while not super high, probably more elevated than the RBA would like.

All these factors have kept downward pressure on rates, in line with the general experience across developed countries.

Do you think interest rates will increase in 2022?

AMP’s view is that interest rates will increase in 2022 for the first time in over 10 years. At the moment we think the first hike will probably be in August and another one in September, and by the end of the year the RBA cash rate will be up to 0.5% from 0.1%.

An earlier rate hike is possible and the earliest it could probably happen is around June. May is complicated by the upcoming federal election as the RBA usually tries to steer clear of any perception it’s influencing political outcomes. So they’ll probably try to wait until the election’s out of the way and also see what’s in the Federal Budget, although this could be a little redundant if there’s a change in government, which appears to be a distinct possibility if you believe the betting odds.

It’s important to remember that even if we do get interest rate hikes this year, the cash rate will still remain pretty low. Next year we expect more rate hikes to take the cash rate to between 1.25% and 1.5% by the end of 2023.

What are the main factors the Reserve Bank will take into account when deciding whether to raise rates?

Like most central banks around the world, the main issue here is inflation, which has been running at a much higher than expected pace.

There are a few reasons for this. The pandemic is causing disruption to supply chains and that’s leading to increases in the price of transporting goods and higher commodity prices.

There’s also been a huge increase in monetary and fiscal stimulus over the past two years, boosting demand for goods and contributing to higher prices.

While the supply chain issues are probably not going to last for ever and should start to ease off by the end of this year, it looks like the price of goods has shifted on a more long-term basis (from higher demand) and services inflation will rise as spending gets back to pre-Covid levels. As a result, we think inflation will be persistently higher than it has been over the past few years.

As well as inflation, the RBA is also looking very closely at the lower unemployment rate and signs that a pickup in wages growth is likely this year.

What do changes in interest rates mean for Australian consumers and households?

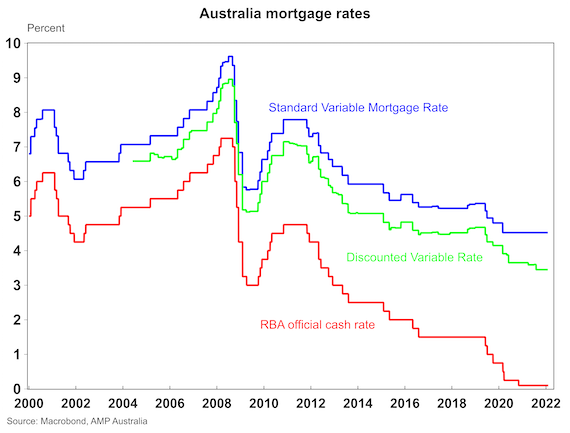

As you can see in the graph below, variable mortgage rates tend to follow the RBA cash rate so an increase in official cash rates will probably mean higher variable rates for mortgage holders.

And of course, even if you’re on a fixed interest rate for your home loan then when you roll over to a variable rate your interest rate will be higher.

So this is certainly something to take into consideration when you’re looking at your budget over the next few years.

But we think in this overall cycle any rate hike will be limited to around 200 basis points, or 2%, so we should keep it in perspective. Banks usually make sure there’s a buffer of about 2.5% when they look at serviceability of a new home loan and that’s been increased recently to 3%.

So even a 2% rate hike should be pretty sustainable for the majority of households. Naturally, like any rate increase it will probably lead to weaker home price growth and weaker consumer spending but it’s unlikely to be enough to cause a severe downturn in the Australian economy

There’s a perception Australians are too leveraged when it comes to property. Is this correct?

Pretty much so. Australia does have a very high debt to income ratio compared to other countries. Total household debt to income in Australia is 184.6% versus 101% in the United States, 175% in Canada and 124% in New Zealand, although places like Canada and New Zealand have similar housing markets in that they’ve been quite frothy over recent years, with big demand for homes and that’s increased the value of house prices there as well.

If you’re looking for positives, at least the value of the underlying assets has gone up significantly but the degree of leverage does leave households potentially exposed to higher rates.

One interesting aspect of this is that being so leveraged could act as a brake on rate hikes. It’s possible that if rates go up by 1% there’ll be a larger negative impact on the housing market and consumers than expected, so the RBA won’t be able to raise rates much further. It’s a little bit of an unknown until you get there, but at this stage we think a gradual 2% rise over the next three or four years is the most likely scenario.

What effect will any rate rise have on house prices?

It’s likely to have a negative impact but having said that, the housing market has been extremely strong during the pandemic. That’s not just because of low interest rates, it’s because of other factors increasing demand for housing—like people wanting extra room to work from home, deciding to switch to a bigger property for lifestyle factors and having spare cash they’d usually spend on travel. This has all allowed consumers to pump more money into the housing market.

Recent growth has left the housing market very exposed to rate hikes but there are already signs it’s losing a bit of steam even before any hikes.

In the first half of 2022 we expect some positive growth in house prices but over the second half of the year we expect minor falls. So for 2022 as a whole we see home prices increasing by 3% and then for 2023 we expect a fall of about 5-10%.

What does this mean for Australians paying down their mortgage?

The next few years could be a tougher time to pay your home loan off more quickly as you’ll have less ability to pay down your principal if the interest component of your loan is increasing.

How you respond really depends on your circumstances. If you know you’re going to have some spare funds or get a big windfall over the next few years, then you probably won’t want to fix 100% of your mortgage.

But if we’re in a rising-rates environment then fixing at least some portion of your mortgage could make sense at this stage in the cycle.

And what about people who are thinking of buying or selling a home?

If you need to sell your house it’s incredibly difficult to time the market—in some ways you just have to trust to luck, while doing all the usual things to make your property an attractive purchase. But in general the next few years will be a softer housing market, so if you’re thinking of selling, it might be better to do it sooner than later.

People get this idea that an interest rate hike is the end of the world. But any increases should be gradual and overall rates aren’t likely to go up by anything more than 1-2% over the next few years. And hopefully we’ll get some wages growth to offset the pain.

Source: AMP February 2022

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling ph 07 4659 9881, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.