Despite numerous geopolitical threats (Eurozone elections, tensions between the US and China, North Korea, etc.), worries about the demise of the so-called “Trump trade” and shares being overbought and due for a correction at the start of the year, share markets have proved to be remarkably resilient with only a minor pull back into their recent lows. This despite a more significant fall back in bond yields. Partly this is because the geopolitical threats have not proven to be major problems (at least so far) and Trump remains focussed on his pro-business policy agenda (he has already embarked on deregulation and his tax reform proposals – while lacking in details – indicate that tax reform remains a key objective). More fundamentally though, markets have been underpinned by an improvement in global growth. This is likely to continue.

Despite numerous geopolitical threats (Eurozone elections, tensions between the US and China, North Korea, etc.), worries about the demise of the so-called “Trump trade” and shares being overbought and due for a correction at the start of the year, share markets have proved to be remarkably resilient with only a minor pull back into their recent lows. This despite a more significant fall back in bond yields. Partly this is because the geopolitical threats have not proven to be major problems (at least so far) and Trump remains focussed on his pro-business policy agenda (he has already embarked on deregulation and his tax reform proposals – while lacking in details – indicate that tax reform remains a key objective). More fundamentally though, markets have been underpinned by an improvement in global growth. This is likely to continue.

Global economy best in years

Numerous indicators point to a stronger global economy.

-

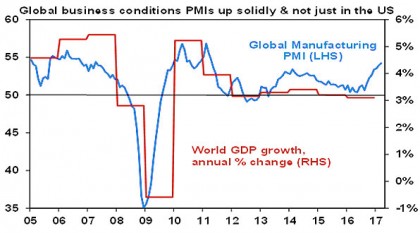

Business condition indicators – commonly called purchasing managers’ indexes or PMIs – have moved up to their highest since the post GFC bounce.

Source: Bloomberg, AMP Capital

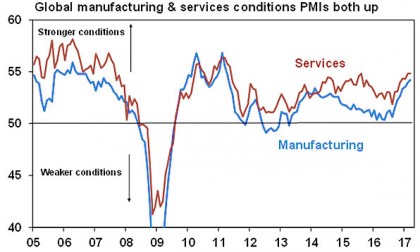

This is the case for manufacturing and services sectors and for advanced and emerging countries. This generally points to stronger growth ahead. Believe it or not the Eurozone currently looks to be the star performer on this front.

Source: Bloomberg, AMP Capital

-

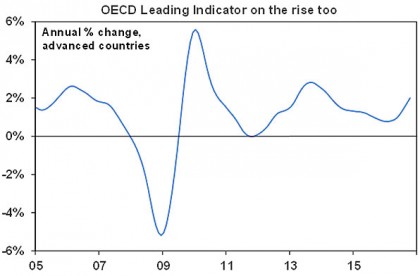

The OECD’s leading economic indicators (basically a combination of economic indicators that lead economic growth) have turned up decisively.

Source: OECD, Bloomberg, AMP Capital

-

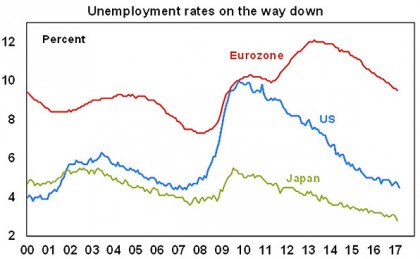

Consistent with improving global economic conditions, measures of unemployment are heading down in the major advanced countries (albeit they still have further to go in Europe).

Source: Bloomberg, AMP Capital

-

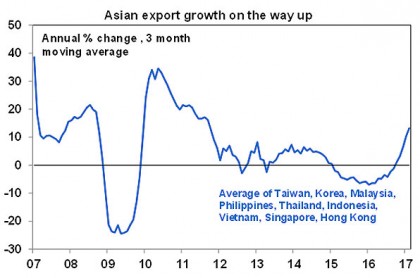

Asian economies which are always a good barometer of the health of the global economy are seeing a solid rebound in export growth. So much for all the talk that world trade and globalisation had peaked!

Source: Bloomberg, AMP Capital

-

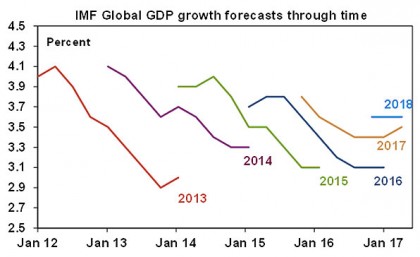

Reflecting the improvement in global growth, for the first time in years the IMF’s latest World Economic Outlook update revised up its global growth forecast for the current year (2017) to 3.5% from 3.4% rather than revised it down as had become the norm.

Source: IMF, AMP Capital

Of course, there is one qualification to all these positive signs (there is always something!) and that is that the US economy looks to have seen a soft start to the year as measured by GDP growth. However, March quarters in the US seem to regularly come in on the soft side initially only to get revised up later and be followed by a bounce back in growth suggesting a seasonal adjustment problem. US unemployment claims running around their lowest since the early 1970s – no mean feat given that the US economy and population are much bigger today – tell us that the US economy remains strong despite a soft March quarter.

So why the turn for the better in global growth?

There are a bunch of factors driving healthier global growth including:

-

Years of ultra-easy monetary policy – zero and even negative rates and money printing – have finally got traction.

-

Fiscal austerity has largely come to an end.

-

Memories of the global financial crisis (GFC) and hence fears of another re-run are gradually receding – after all it is now 9-10 years ago (shares peaked in 2007!) – and so the negative impact on confidence is gradually receding too.

-

Deleveraging (or the desire to reduce debt ratios) post the GFC – to the extent that it occurred – has arguably run its course.

Investment implications

The pick-up in global growth is not so strong as to tell us that we are near the peak of the cycle. Spare capacity remains in labour markets, factories are still not running at full capacity, wages growth remains relatively weak (albeit it’s trending up a bit in the US) and core inflation remains low (just 0.7% year on year in the Eurozone, 0.1% in Japan, 1.8% in the US and 2.3% in China). Out of interest the US Leading Economic Indicator has only just surpassed its pre GFC high and historically it’s then taken six years on average for the next recession to start.

In other words we are a long way from boom times that then give way to a bust. Nevertheless, the implications of the healthier global economy are likely to be:

-

Ongoing support for share markets – as stronger growth underpins further gains in profits – which should mean reasonable returns from shares.

-

Support for commodity prices – although it’s doubtful they will take off given the lagged impact of rising supply but it should mean we have seen the lows.

-

A bottoming in the global interest rate cycle. The Fed will continue its gradual tightening in monetary policy in the US with two more rate hikes likely this year and a start to reversing quantitative easing later this year via a phased reduction in the Fed rolling over its bond holdings as they mature. China is likely to continue tightening gradually as well. Other countries will eventually follow (albeit very slowly in Europe and then in Japan – but that could be years away).

-

A resumption of the rising trend in government bond yields – after the pause seen since December – which is likely to mean low returns from government bonds.

-

A rising trend in bond yields – albeit a gradual one – will weigh on bond proxies such as global real estate investment trusts and listed infrastructure assets constraining their returns relative to the double digit gains they have seen over the last five years in response to the prior plunge in bond yields.

For Australia, the stronger global growth back drop is a positive in supporting export demand and confidence which in turn should help support Australian economic growth pick up towards 3%. Which in turn adds to confidence that the official cash rate has bottomed. However, with downside risks to growth remaining as mining investment is still falling, underemployment remaining very high, wages growth still ultra-weak, the $A remaining relatively strong and core inflation remaining below target we remain of the view that an RBA rate hike is unlikely until the second half of 2018.

If you would like to discuss anything in this report, please call us on ph 07 4659 9881 or email admin@hmfs.com.au.

Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.